tax identity theft definition

The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return.

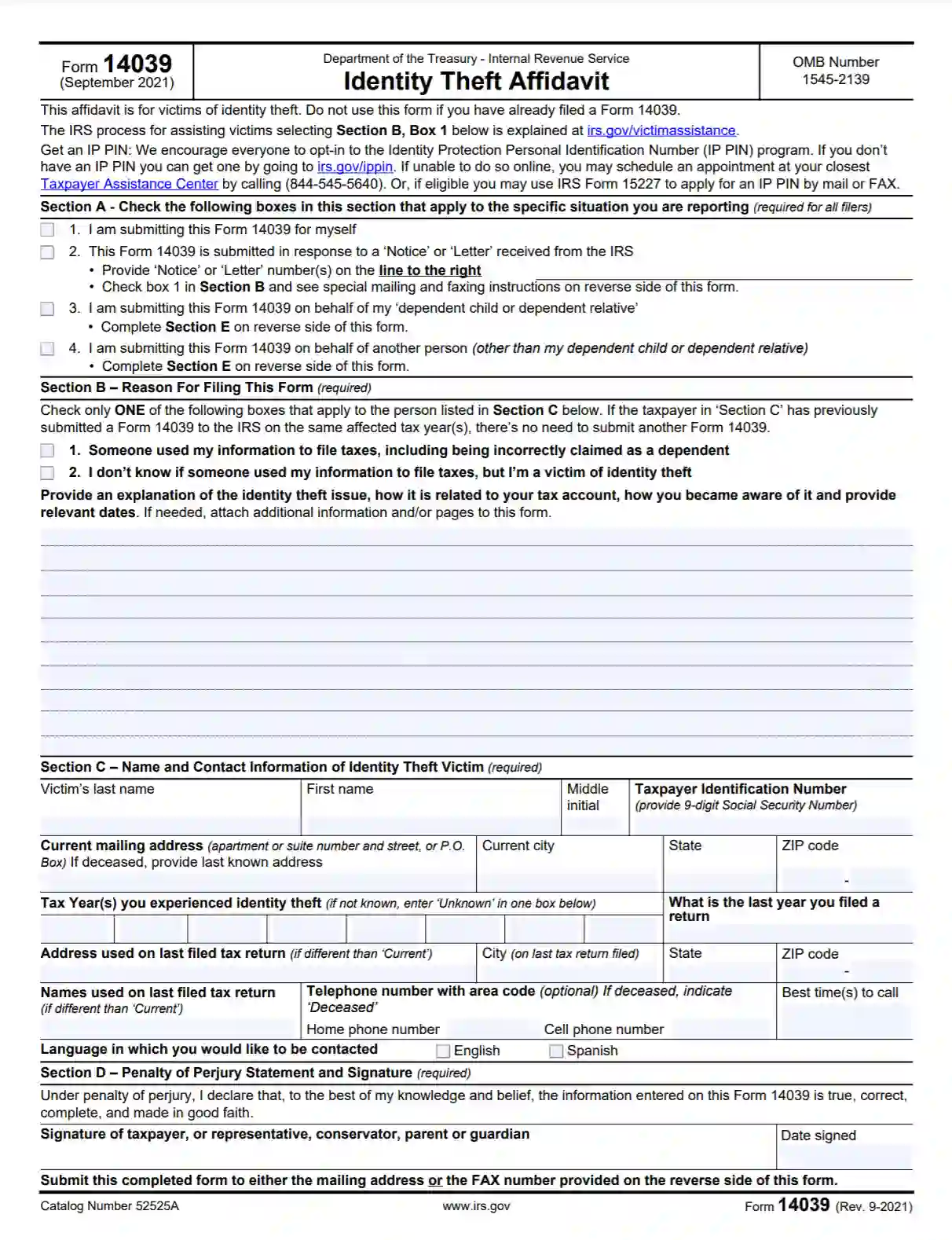

If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you must file a paper return.

. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that youre entitled to one. The IP PIN authenticates you as the valid filer of the return. Convert them into templates for multiple use include fillable fields to collect recipients.

Tax identity theft definition. The most common method is to use a persons authentic name address and Social Security Number to file a tax return with false information and have the resulting refund direct-deposited into a bank account controlled by the thief. One of the major identity theft categories is tax identity theft.

Go to IdentityTheftgov or call 1-877-438-4338. Information put and ask for legally-binding electronic signatures. Since 2015 the Department has stopped over 108 million in fraudulent tax refunds.

These new measures are. As stated previously on this page you may also consider obtaining an Identity Protection PIN IP PIN to protect your account against tax related identity theft. Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve.

Include as many details as possible. Tax-related identity theft occurs when someone uses your personal information such as your Social Security number to file a tax return to collect your tax refund. Financial identity theft seeks economic benefits by using a stolen identity.

Equipped with three simple ingredients a name birthdate and Social Security number the thief can commit tax fraud resulting in delayed or stolen refunds. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. Tax ID theft - Someone uses your Social Security number to falsely file tax returns with the IRS or your state Medical ID theft - Someone steals your Medicare ID or health insurance member number.

The US Internal Revenue Service doesnt get much love from taxpayers but the organizations efforts to reduce tax-related identity theft appear to be working. Identity theft occurs when someone fraudulently obtains or uses your personal information such as your name social security number or credit card number. Tax identity theft sometimes called tax fraud occurs when a thief uses your information to file a fraudulent tax return to steal money from the IRS.

People often discover tax identity theft when they file their tax returns. Basically its identity theft plus tax fraud. This might come as a result of a data breach that exposes your SSN online for example.

More from HR Block. What Is Tax Identity Theft. Tax identity theft occurs when a scammer gets a hold of your SSN and uses it to obtain a tax refund or get a job.

Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like Social Security Numbers or Individual Taxpayer Identification Numbers for one of two reasons. The IRS will inform you that a tax return has already been filed in your name. Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in.

Thieves use this information to get medical services or. All a thief needs to file a fraudulent tax return is your name date of birth and Social Security number which is why tax identity management and tax fraud protection is so important. They do this to receive tax refunds.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. The Department of Revenue is committed to taxpayer security and preventing refund fraud. But when a fraudster files a fake return in your businesss name you could wind up with tax penalties and an audit.

Report identity theft to the FTC. Take advantage of a electronic solution to develop edit and sign documents in PDF or Word format online. You might not know until you try to file your tax return.

See the IRS Taxpayer Guide to Identity Theft for guidance and consider submitting a Form 14039 PDF. Tax ID fraudsters file early because they have a treasure trove of stolen personal information names dates of birth Social Security numbers and theyre eager to use that. The IRS in partnership with the state tax administrations and the software companies that produce at-home filing software has announced several changes.

Employment identity theft is often more difficult to detect than some forms of identity theft like existing account takeovers for example which if you check your bank statements. Tax identity theft occurs when an identity thief uses a taxpayers stolen identity to file a fraudulent return and claim the identity theft victims tax refund. The identity thief will use a stolen Social Security number and consumer information to file a forged tax return early in the filing season before the victim files.

Tax return identity theft is the act of filing a return using a stolen identity and taking the victims refund. Although many of us dont start thinking about filing our taxes until the flowers start to bloom there is one group of people who enjoy filing taxes as early as possible. The accepted employment identity theft definition is when another person uses your identity usually in the form of a social security number to apply for a job under false pretenses.

An identity thief could steal your companys identity and file a fake small business tax return. Unlike some other forms of identity theft it can be hard to take preventative measures to avoid tax identity theft. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund.

This is the most common type of identity theft. This happens if someone uses your Social Security number for employment or they used the information from your W-2 to file income tax returns on your behalf and take your tax refund. Work from any device and share docs by email or fax.

You may choose to file a report with your local police department. Based on the information you enter IdentityTheftgov will create your Identity Theft Report and personal recovery plan. In this type of exploit the criminal files a false tax return with the Internal Revenue Service IRS for example using a stolen Social Security number.

Tax Identity Theft American Family Insurance

Identity Theft Definition How To Prevent How To Report

Learn About Identity Theft And What To Do If You Become A Victim

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

Pdf Identity Theft And Fraud Type

Tax Identity Theft American Family Insurance

Types Of Identity Theft And Fraud Experian

![]()

Business Identity Theft National Cybersecurity Society

Identity Theft Examples In Real Life Fully Verified

Identity Theft Definition What Is Identity Theft Avg

What Is Identity Theft Definition From Searchsecurity

Identity Theft Definition What Is Identity Theft Avg

What Is Identity Theft Definition Types Protection Study Com

![]()

Business Identity Theft National Cybersecurity Society

The Crime Of Identity Theft And Fake Accounts In The Philippines Philippine E Legal Forum

![]()

Business Identity Theft National Cybersecurity Society

Irs Form 14039 Fill Out Printable Identity Theft Affidavit

Pdf Identity Theft Identity Fraud And Or Identity Related Crime

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)